The Rachel Reeves Budget 2024 – from Jilly Mann

After much press speculation, we have finally heard the content of the new Labour Government’s first Budget speech. The last few weeks have been as troubling a time for investors, speculating about what changes may be ahead, than I can recall for many a year. The Liz Truss Budget was a lightning flash in its impact and build up, the Rachel Reeves Budget has felt like a looming thunder cloud where nobody knew what the impact would be.

We will address some of the key areas that affect our clients in turn.

Tax-free cash from pension funds

Many clients have been concerned about rumours that Labour would abolish or at least cap the ability to draw tax-free sums from pensions. We have fielded numerous enquiries on this subject in the last couple of months and have been frustrated that we couldn’t give a definitive answer as to what action to take. Our hunch was that the ability to draw tax-free cash wouldn’t be removed, because it would impact the public sector as widely as the private sector. The broader pronouncements from Labour indicated that this wouldn’t be a consequence that they would be happy with. Nonetheless, they didn’t do anything to quell the debate, and this has resulted in many people across the country choosing to protect their tax-free cash sums by withdrawing it ahead of the budget, whilst the ability to do so existed. Labour have announced no changes to the ability to withdraw tax-free cash sums from pensions.

That is not to say that they may not change their stance in the future, having flagged it as a possibility, but our view when preparing for this Budget was to consider the impact on both the private and public sector and err on expecting policy changes that would impact the private sector far more than the public sector

Tax relief on pension contributions

There were no announcements in the Budget about any changes to the tax reliefs available on pension contributions and so the status quo for basic rate and higher rate taxpayers continues. There were also no changes announced with regards to the annual allowance for pension contributions nor the calculation of carry forward pension contributions from previous tax years.

Why? Again, we think that any changes in this area would impact the public sector as much as the private sector. Public sector pensions are a complex animal and so the Government need more time to consider the ramifications of changes in this area and perhaps this Budget came too soon for that.

Inheritance tax on pensions

This is the big area of change for pensions, but so far the change will really only impact private sector pensions as opposed to public sector pensions. The latter typically operate as annuities with a survivor’s income being paid out, whereas private sector pensions typically leave a residual pension fund, which can be inherited by dependents either before or after the deceased has started to draw retirement benefits. We need greater clarity from the Government on this, but Rachel Reeves announced that “inherited pensions” would be brought into the inheritance tax regime from April 2027.

Logically and from a tax revenue collection perspective, the announcement suggests that any pension fund remaining at the date of death will then be included within the estate of the deceased for inheritance tax calculation purposes. I say logically, because “inherited pensions” was an odd turn of phrase, and we have all seen the dangers of interpreting phrases such as “working people” over the last few weeks. The alternative of inheriting a pension and then paying inheritance tax on it at the time of the beneficiary’s death doesn’t seem practical. Some people may not have beneficiaries, pensions are often split between multiple parties and the beneficiaries may deplete the pension fund so that there is no fund left on their own death upon which to pay inheritance tax.

National insurance rise for employers and the reduction in the secondary threshold

I will leave accountants to comment on the detail of the changes to national insurance contributions for employers, but allying this rise with a rise in the national living wage and the potential knock-on impact on pension contributions, it has felt like a tough Budget for employers.

I mention pension contributions, because there may be a knock-on impact for employers who provide workplace pension schemes for staff on a banded or qualifying earnings basis. The Government have previously considered aligning the automatic enrolment trigger for workplace pensions with the secondary threshold for national insurance contributions, which is reducing to £5,000 from £9,100 per annum. Whilst no changes were announced yesterday and the trigger for automatic enrolment remains at £10,000, if workplace pension thresholds are amended in the future to align them with national insurance thresholds, employers will likely find that more employees need to be enrolled into workplace pension schemes, which in turn will increase the effective wage bill arising from employing someone.

For businesses in the leisure sector, this could be a major problem, especially with the rate relief reduction from 2025/26 changing from 75% relief to a 40% relief. Many employers in this sector will be those with employees on lower or part time wages.

Capital Gains Tax

Capital Gains Tax (CGT) has been mooted to rise every year for a while, as an almost easy target for Governments. Raising the rate of CGT too high would dampen enthusiasm for selling assets and would potentially lead to a stagnant market that in turn cuts tax revenues rather than increases them. The Budget announced a rise from 10% to 18% as the lower rate of CGT and a rise from 20% to 24% as the higher rate of CGT.

CGT on residential property disposals remains unchanged at 18% and 24% respectively. The residential rate of CGT impacts landlords who are looking to sell buy-to-let residential property, although a stamp duty surcharge increase to 5% with immediate effect will stymy the buy-to-let market and also potentially, the second home market.

It wasn’t so long ago that CGT rates in the UK for non-residential property were 18% and 28%, so the proposed changes could have been far worse and in reality, generating capital gains rather than chargeable gains which are taxed as income tax, remains preferable.

Business Asset Disposal Relief (formerly Entrepreneur’s Relief)

The Government have maintained the £1 million cap on Business Asset Disposal Relief with a reduced tax rate of 10% for now. The tax rate will rise to 14% from 2025, up to 18% in 2026. This still represents a discount on standard capital gains tax rates but is less attractive than the previous rate of 10%. This shouldn’t be enough to stifle business acquisition but reduces the incentives to do so.

Agricultural Property Relief (APR) and Business Property Relief (BPR)

We have many farmers amongst our clients and the changes to APR were feared, but have come through. From April 2026, the first £1 million of agricultural property will be free from inheritance tax, but thereafter an effective 20% inheritance tax rate will apply to assets above £1 million. This will end up pulling a new sector of the public into inheritance tax.

BPR will be impacted similarly, with a £1 million tax free threshold and an effective rate of 20% inheritance tax thereafter. This could impact many family businesses in the UK who typically pass down assets through generations.

However, this is a major blow for family-owned farming businesses, and it could mean the end of farmers passing on their farms from one generation to the next. Farmers tend to make small profits and so they don’t generally have large amounts of money tucked away, the value is in the land that the farms own. The average UK farm owns around 200 acres and at current values (£11,300 per acre), this puts a value of £2.3m on a farm before taking into account other assets, such as a farm house, other buildings and machinery. This could mean inheritance tax bills of £252,000 or more on the land alone which would probably have to be raised by selling the land.

Farmers are some of the most hard working people in the UK and given the Government’s pledge not to raise taxes on “working people” many will feel deeply concerned about the changes to APR.

UK AIM Market

The UK AIM market used to be free from inheritance tax for investors, but the Government announced an effective rate of 20% inheritance tax on AIM listed assets. AIM is the junior market to the better-known FTSE 100 and 250 markets. The FTSE AIM market has been trending downwards since Labour won the UK election amidst fears that they would abolish tax relief on AIM investments entirely. The 50% reduction is being seen as something of an escape. Inheritance tax at 20% rather than 0% on the AIM market is not wholly positive, but it does still send a message to the wider globe that investing in junior UK markets is to be encouraged. The FTSE AIM index immediately bounced upon the Chancellor’s announcement in the hope that this will encourage further growth and investment.

Income tax thresholds

There were no changes announced to income tax rates, but the Chancellor has announced that the freeze on income tax thresholds will be lifted beyond 2028/2029, which should then see tax bands rise in line with inflation again. This sounds encouraging, but that is over 3 years away and a lot can change between now and then.

ISAs

No changes were announced to ISAs and so the current ISA allowances continue for the foreseeable future.

Private school VAT and business rates charitable relief

Something that may affect some clients is the removal of business rates charitable relief on private schools from April 2025 and making private school fees subject to VAT from January 2025. The VAT point has been known for a while, but has simply been formalised in the budget. The business rates charitable relief point is more unexpected, but will lead to greater challenges for the private education sector, who are already seeing outflows of students. If there were surplus state school places up for grabs, this would perhaps be less of an issue, but given the funding situation in state schools, perhaps this is a policy where the optics are more important to the Government rather than the practicalities.

Inflation, interest rates and a change in fiscal rules

Inflation and interest rates are not directly controlled by the Government and these weren’t Budget announcements, but Labour’s decision to change the fiscal rules could directly impact both inflation and the UK’s interest rate trajectory.

In essence, the Public Sector Net Worth measurement is being introduced and this calculates the fiscal position as a total measure of what the Government owns, minus what it owes. This then targets the Government to increase the assets that it owns by investing into infrastructure as an example, rather than purely seeking to reduce debt. Rachel Reeves repeatedly threw out the notion of an austerity Budget in her speech and this is why. By focusing on investment rather than debt she is effectively redefining UK debt and taking the focus away from the need to reduce interest rates to thus make servicing our debt more affordable.

A reason stated for previous Governments not implementing this change in the past, is due to the fear of higher interest rates for longer as a net consequence.

Our investors will be aware of our overweight position to fixed interest assets as opposed to equity and our belief that when interest rates start to fall, fixed interest assets will rise significantly without the inherent risk that equity markets present. The theory being that as interest rates reduce, capital values for fixed interest assets rise. Rightly over the last couple of weeks we have been asked why we are seeing fixed interest yields rising, with capital values stumbling a little, when all reports are that the Bank of England are likely to cut interest rates by 0.5% at the next meeting in November 2024. i.e. the reverse of what we have been expecting. The answer in part lies within this change to the UK’s fiscal rules.

The US Federal Reserve were late to the party with their interest rate cuts, but they are now fully in an interest rate cutting cycle, regardless of the US Presidential election outcome. The run up to the US election naturally tempers Treasury yields a little, but the direction for US interest rates seems clear cut.

The UK was also in the most certain position that it has been for years when the last inflation print came in below 2%, commentators weren’t being timid and expecting a 0.25% cut to interest rates, a 0.5% cut was on the cards. With uncertainty over the extent of Labour’s Budget and the impact on longer term interest rates arising from a change in fiscal measurement, yields have risen. This is slightly unchartered territory as markets are still digesting the announcements and the likely effect this will have on Bank of England policy, if any, but history demonstrates that when interest rates fall, capital values rise.

Even if the new fiscal measure holds interest rates higher than they have been over recent times, one would still expect to see them fall from their current position and so we think that the Bank of England will press on with a cut at the next meeting, we will see fixed interest assets reward investors, albeit that perhaps a sticky interest rate of around 3% – 3.5% may be the new normal to reward investors into the UK which Reeves needs to attract, whilst not punishing the wider population who are trying to manage bills and mortgage payments.

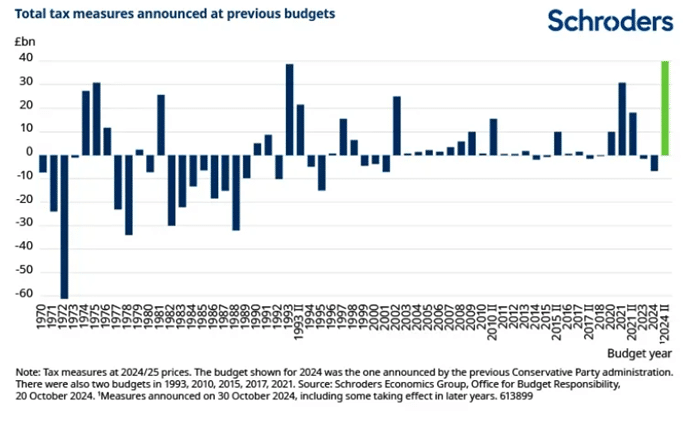

Overall tax raise from the 2024 Budget

Whilst we have highlighted some of the key areas that affect our clients in this update, taking into account all of the measures introduced by the Chancellor, the Government had sought to raise a further £40 billion in tax, which is the highest tax raise in cash terms since at least 1970. The graph below charts all Budget tax measures since 1970, with only Norman Lamont’s 1993 Budget coming close.

Impact on portfolios

The devil remains in the detail for this Budget, but there were some encouraging signs for UK investments and we now have certainty on the extent of the Government’s tax policy which always provides stability. The rhetoric of the last couple of months has at times felt irresponsible and left people taking action based on fear rather than reason. When that action affects retirement plans and people’s futures, it is frustrating to be unable to offer guidance with any certainty.

At a small business level, this Budget will pose challenges and that is without factoring in changes to employment law that are always harder to incorporate on a smaller scale than in larger organisations, who have multiple departments employed to deal with such changes. For slightly larger businesses, encouraging growth in the UK is essential, whether Labour have struck the balance between encouraging growth and putting investors off with an increased tax burden to reward such growth, remains to be seen. Initial reaction seems more positive in the FTSE 250 market than the FTSE 100.

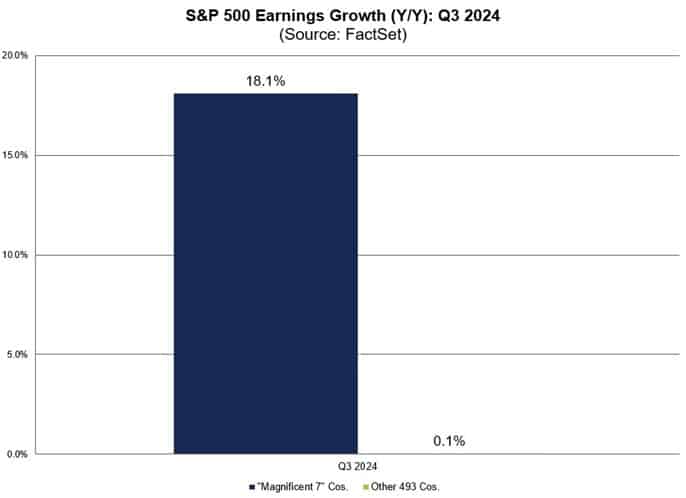

Global signs indicate that our fixed interest weighting is positioned to benefit from a flurry of interest rate cuts and a weakening US market. The chart below sums up our continuing concerns about the imbalance of the S&P 500 index in the US:

The chart shows how the “Magnificent 7” technology stocks in the US accounted for 18.1% earnings growth relative to 0.1% earnings growth arising from the other 493 stocks.

Jobs data and business earnings in the US are reporting at worryingly weak levels consistently and we would rather be in fixed interest assets than equities which could suffer much greater markdowns in valuation in the coming months.

For now, at least we have some clarity on what the future holds, but we will provide a further update as the detail of the Rachel Reeves Budget emerges and as we identify potential solutions for investors impacted by any of these changes.